When I first read the news story about this on CNBC, I was truly taken aback. I’ve thought for some time now that the states would not continue to miss out on the billions (or trillions) of dollars of tax revenue that was being hidden behind the Amazon logo.

When I first read the news story about this on CNBC, I was truly taken aback. I’ve thought for some time now that the states would not continue to miss out on the billions (or trillions) of dollars of tax revenue that was being hidden behind the Amazon logo.

My first thought was about the sellers who have never filed with the State of Massachusetts. What would happen to them? What should they do next? How much money are they going to be expected to pay? That tax liability could be huge.

Because I own a copywriting agency and not a CPA firm, I contacted a friend at TaxJar to shed some light on this topic. Please welcome Jennifer Dunn to the Marketing Words Blog as she and a team of tax experts help Amazon FBA sellers make heads or tails out of this new development.

—————————————-

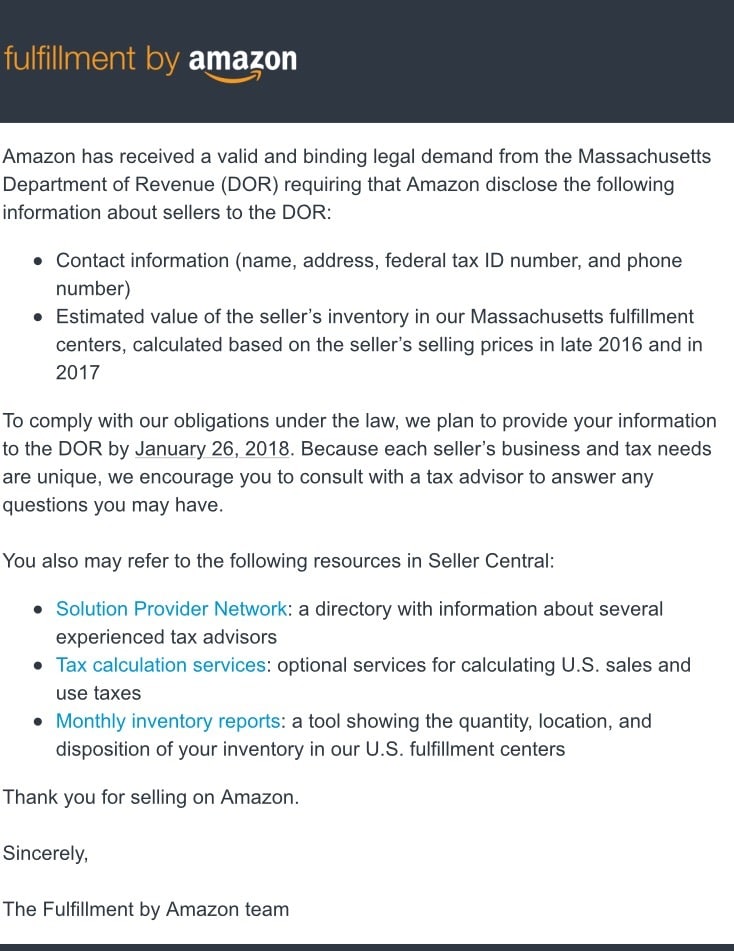

Some Amazon FBA sellers recently received an email from Amazon notifying them that, due to a court order, their identifying info would be shared with the Massachusetts Department of Revenue. Amazon reported that they were required to share the following by Friday, January 26, 2018:

-

- Seller contact information (name, address, federal tax ID number, and phone number)

- Estimated value of the seller’s inventory in Massachusetts fulfillment centers, calculated based on the sale price in late 2016 and 2017.

What does this mean for Amazon FBA sellers?

The State of Massachusetts considers businesses that have inventory stored in the state to have a sales tax nexus in the state. For Amazon FBA sellers, this means any seller who has inventory stored in Massachusetts’ Amazon fulfillment center is required to register for a Massachusetts sales tax permit and collect sales tax from their Massachusetts buyers.

According to TaxJar’s Sales Tax Analyst and former Sales Tax Auditor Graham Martin, Massachusetts’ next step is likely to compare the seller information from Amazon to their current sale tax roles to determine if sellers with inventory stored in the state are collecting sales tax. From there, they will likely send out letters to the sellers whose information they received from Amazon.

What to do you if you received this notification

To answer sellers’ questions about how to proceed after Amazon shares your information with Massachusetts, we turned to a panel of experts to find out what this means for FBA sellers.

You can get detailed information, determine your tax liability, and watch a replay of the “Ask the Experts: Amazon Is Sharing My Info With Massachusetts, What Do I Do?” webinar.

The experts’ most common advice boiled down to:

-

-

- Assess your risk in Massachusetts — Lauren Stinson, National Sales Tax Leader at Cherry Bekaert, advises sellers to determine how much sales tax you should have collected in Massachusetts had you been collecting.

- Assess your risk in other states — Mike Fleming, Director at Peisner Johnson, added that sellers should assess sales tax risk in other states, should those states follow suit and also get court orders against Amazon.

- Plan a course of action — Stinson advised that if you owe more than about $2,500 in sales tax to the State of Massachusetts, it may be advisable to work with a sales tax expert and obtain a voluntary disclosure agreement (VDA). If you owe a lesser amount, it may be advisable to register preemptively with the State of Massachusetts (though each business’s situation is different), and the right course of action to mitigate sales tax liability will vary.

-

If you received this notification from Amazon and are unsure what to do next, we always recommend working with a vetted sales tax expert.

TaxJar is a service that makes sales tax reporting and filing simple for more than 10,000 online sellers. Try a 30-day-free trial of TaxJar today and eliminate sales tax compliance headaches from your life!

I thought you had to have a significant sales volume in a state before you were required to collect tax. I mean other than the state you operate your business from. I had also heard that nexus occurred when you had over 10k (not quite sure of the amount) in sales. Are they really expecting sellers on a small scale to register and collect tax on, say 1 or 2 hundred dollars a year?

Hi Bill,

Unfortunately only Tennessee has a low threshold for nexus. (That threshold is $400/month or $4800 total per year.) The rest of the states consider any retailer making retail sales to be required to register for sales tax. That said, that doesn’t always make sense, especially for a new or low volume seller. We have a great blog post and whitepaper that talks all about that. That whitepaper was written by the accountants at Catching Clouds and includes some matrices to help you decide when is the right time for your business to register for sales tax. I hope this points you in the right direction!

Thanks!

Hi Bill. I’ve contacted Jennifer from TaxJar to answer this question for you.